maricopa county tax lien auction

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. Interested in a tax lien in Maricopa County AZ.

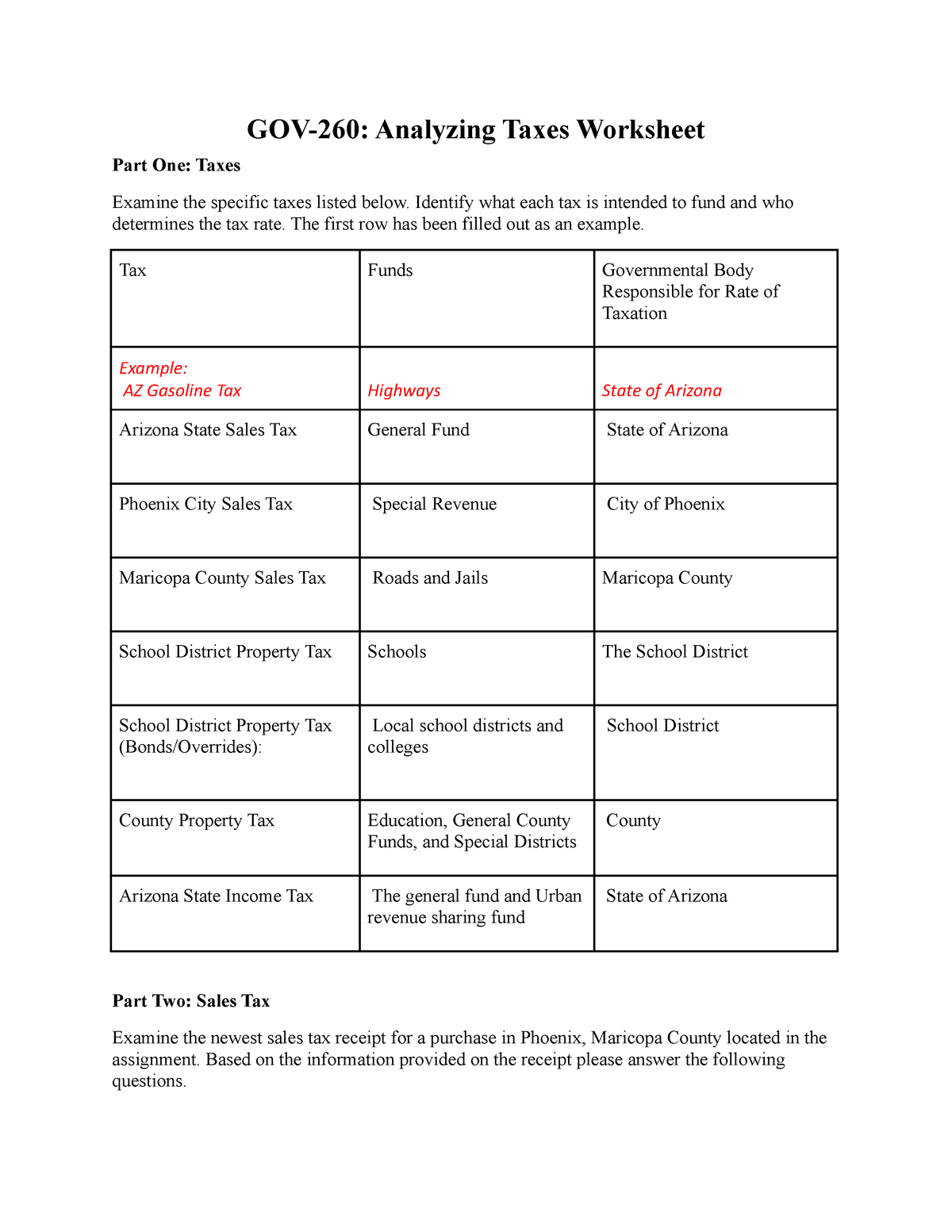

Analyzing Tax Worksheet 1 Gov 260 Analyzing Taxes Worksheet Part One Taxes Examine The Specific Studocu

These listings may be used as a general starting point for your research.

. Some counties such as Maricopa County Pinal County and Apache County hold their auctions online. For more assistance with your research please speak with an Information or Reference Services staff member. As of september 14 maricopa county az shows 17298 tax liens.

Other counties such as Pima County and Cochise County hold live auctions. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. Delinquent and Unsold Parcels.

10427 E JAN AVE MESA 85209. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. They have bought many more in Maricopa County and other states like New Jersey and Florida.

When a Maricopa County AZ tax lien is issued for unpaid past due balances Maricopa County AZ creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. Maricopa County AZ currently has 22642 tax liens available as of February 14. Excess land is land which was acquired as part of a project and is no longer needed by that Department.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. The sale of maricopa county tax lien certificates at the maricopa county tax sale auction generates the revenue maricopa county arizona needs to continue to fund essential services. Maricopa County pays up to 16 for tax lien certificates which are sold via a bid down auction.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. You can now map search browse tax liens in the Yavapai Coconino Apache and Maricopa 2022 tax auctions. Free and simple bulk payment solution for Mortgage Companies Tax Servicing Companies Developers and other multi-account payers.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. Register for 1 to See All Listings Online. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

Ad Buy Tax Delinquent Homes and Save Up to 50. How does a tax lien sale work. The Tax Lien Auction Each county Treasurer handles the tax lien auction a little differently.

The Tax Lien Sale will be held on February 9 2021. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. Maricopa county tax lien auction.

Office personnel determine the withdraw and location of the Maricopa County Arizona tax sale. Search our database of maricopa county property auctions for free. Ad Foreclosure properties updated daily.

Tax lien certificates can best transfer ownership of complex tax debts an investor interested in redemption would target owner occupied properties with attached mortgages. Completed forms may be mailed or delivered to. SELECTED LAWS REGULATIONS AND ORDINANCES.

TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library. Either way bidders are required to register with the Treasurer to obtain a bid. In Maricopa County Arizona the first half of real estate property taxes is due on October 1 and are delinquent after December 31st of each year.

Visit Arizona tax sale to register and participate. Some counties such as maricopa county pinal county and apache. CRISMON CREEK UNIT 2.

Auctions Leases The Maricopa County Real Estate Department is responsible for auctioning excess land owned by the Flood Control District of Maricopa County District and the Maricopa County Department of Transportation MCDOT. As of October 2 Maricopa County AZ shows 1469 tax liens. JOHN AND LIEN NGUYEN JOINT LIVING TRUST.

The sale of Maricopa County tax lien certificates at the Maricopa County tax sale auction generates the revenue Maricopa County Arizona needs to continue to fund essential services. Click here to download the available State CP list. Maricopa County Treasurers Office 301 West Jefferson Room 100.

Tax Liens in Maricopa County AZ Displaying 1 - 10 of 11375 Results 0 Watch List Tax Lien NEW View Details More Foreclosures in Mesa E Arbor Ave 50 Mesa AZ 85206 BEDS BATHS SQUARE FEET Mobile Home PROPERTY TYPE Tax Lien NEW View Details More Foreclosures in Phoenix 145605 EMV E Tonto St Phoenix AZ 85004 BEDS BATHS SQUARE FEET Multi-Family. Interested parties must complete an Unsold Previously Offered Parcel Offer Form PDF and submit this form and payment in cash or guaranteed funds Cashiers Check or Money Order made payable to Maricopa County Treasurer. Preview and bidding will begin on January 26 2021.

3313 N APOLLO DR CHANDLER 85224. The above parcel will be sold at public auction on monday october 4 2021 at 1100 am at the flood control district of maricopa county 2801 w. Arizona conducts tax deed sales through book Board all County Supervisors.

LIEN T NGUYEN LIVING TRUST. 95 to 97 of the certificates are redeemed however if you dont get paid you get the property with no mortgage or deed of trust loan making Maricopa. Where and how it works a tax lien sale is a method many states use to force an owner to pay unpaid taxes.

Corporate Services Bulk Payers Contact Us Questions and Research Requests Office Hours 8am - 5pm Monday - Friday except Federal Holidays Customer Service Phone. Auction properties are updated daily on Parcel Fair to remove redeemed properties. Arizona Tax Auction Update 4 counties in Arizona have now released their property lists in preparation for the 2022 online tax lien sales.

Top Republican Casts Doubt On Plan To Break Up Maricopa County

Maricopa County Assessor S Office

Making Sense Of Maricopa County Property Taxes And Valuations

Maricopa County Assessor S Office Linkedin

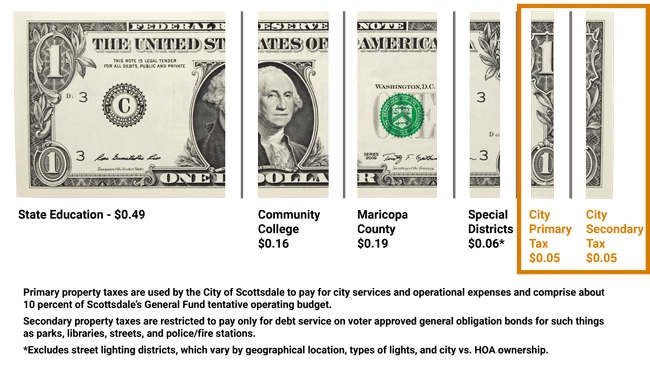

City Of Scottsdale Truth In Taxation Notice

Making Sense Of Maricopa County Property Taxes And Valuations

Bonds Overrides Property Tax Calculator

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Maricopa County Assessor S Office

Tentative 4 46b Maricopa County Budget Includes Property Tax Rate Reduction Ktar Com

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

News Flash Maricopa County Attorney S Office Az Civicengage